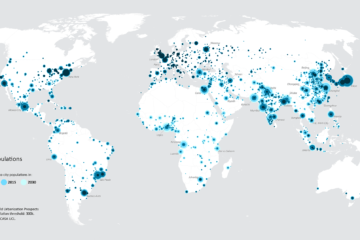

JLL and The Business of Cities have identified 10 such city groups that each have common paths, challenges and imperatives. As locational choices multiply for investors and corporates, it makes greater sense to assess relative economic prospects and real estate market dynamics through the lens of these city groups.

Established World Cities

- The ‘Big Seven’: Accounting for nearly one-quarter of all capital invested in commercial real estate globally, this elite group holds the depth, liquidity and unique soft power to remain the default destinations for cross-border investors and corporates.

- The ‘Contenders’: This group of 10 ‘Contender’ cities have acquired many, but not yet all, of the attributes of the ‘Big Seven’. They are competing successfully for global talent, capital and businesses. Collectively they have registered the fastest growth of any city group in real estate investment over the past cycle.

New World Cities

- The ‘Innovators’: These cities stand out because they have world-class capabilities in science and technology and business climates that foster innovation and entrepreneurship. They attract among the greatest volumes of real estate investment relative to their economic size.

- The ‘Lifestyle Cities’: Cities which possess a high quality of life and international appeal that has become their strongest brand asset, ‘Lifestyle’ cities have experienced some of the highest uplifts in rental values during the last couple of cycles.

- The ‘Influencers’: These are centres of global and regional influence, and their role is linked to hosting transnational institutions and trading functions. They have typically provided some of the most stable real estate markets globally.

Emerging World Cities

- The ‘Megahubs’: These exceptionally large cities in emerging economies have become impressive centres of business services and retail. However, they are failing to punch their weight as real estate investment destinations and need to work on improving real estate transparency.

- The ‘Enterprisers’: These cities in emerging economies are moving rapidly towards a high productivity, high innovation system. They have been among the world’s most dynamic real estate markets in the last cycle.

- The ‘Powerhouses’: This group of mainly Chinese cities are transitioning from low-value industrial economies to find a higher position in the value chain, and are benefitting from strong national government support.

Hybrids and Growth Engines

- The ‘Hybrids’: These cities have attributes of both ‘Emerging’ and ‘New World’ cities. They are typically mid-sized and compete in specialised markets. They have made good progress in improving real estate transparency and have witnessed a transformation in their commercial real estate inventory in recent cycles.

- The ‘National Growth Engines’: These cities are found in stable, developed national economies that profit from access to large domestic markets. The positions they occupy in their national economies will ensure their durability over the medium term. They feature among the world’s top real estate investment destinations.

Original article: http://www.jll.com/cities-research/Documents/benchmarking-future-world-of-cities/Cities-Research-Mapping-Pathways-to-Success-2018.pdf